Not known Incorrect Statements About 1031 Exchange Rules

Table of ContentsIndicators on What Is 1031 Exchange California You Need To KnowThings about California 1031 ExchangeEverything about Capital Gains Taxes In California1031 Exchange Real Estate Can Be Fun For AnyoneOur 1031 Exchange Into A Fund Statements1031 Exchange for Dummies

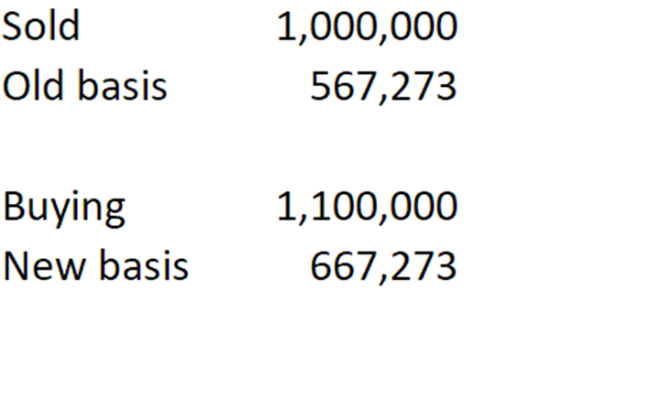

Within 45 days of the transfer of the home, a residential or commercial property for exchange must be identified, as well as the deal must be carried out within 180 days. Like-kind residential properties in an exchange should be of similar value. The difference in value between a home and the one being traded is called boot.If personal effects or non-like-kind building is utilized to finish the deal, it is also boot, yet it does not disqualify for a 1031 exchange. The presence of a home mortgage is permitted on either side of the exchange. If the home loan on the substitute is much less than the mortgage on the residential property being offered, the distinction is treated like cash boot.

Expenditures and costs affect the worth of the transaction and also as a result the possible boot too. Some costs can be paid with exchange funds. These consist of: Broker's commission Qualified intermediary charges Filing charges Relevant attorney's costs Title insurance premiums Relevant tax obligation adviser costs Finder costs Escrow charges Costs that can not be paid with exchange funds include: Funding costs Real estate tax Repair work or upkeep expenses Insurance premiums LLCs can just exchange home as an entity, unless they do a in instance some companions desire to make an exchange and also others do not.

How 1031 Exchange can Save You Time, Stress, and Money.

1031 exchanges are performed by a single taxpayer as one side of the deal. Therefore, unique steps are needed when participants of an LLC or collaboration are not in accord on the personality of a building. This can be quite intricate since every homeowner's circumstance is unique, but the fundamentals are universal.

A 1031 exchange is brought out on residential properties held for investment. Otherwise, the companion(s) taking part in the exchange may be seen by the IRS as not meeting that standard. tax shelter real estate.

This is called a "swap and decline." Like the drop and also swap, tenancy-in-common exchanges are another variation of 1031 purchases. Tenancy in usual isn't a joint venture or a partnership (which would certainly not be allowed to engage in a 1031 exchange), but it is a partnership that allows you to have a fractional ownership passion directly in a large building, together with one to 34 even more people/entities.

1031 Exchange Into A Fund - The Facts

Occupancy in common can be utilized to separate or settle economic holdings, to branch out holdings, or gain a share in a much bigger possession.

The tax deferment provided by offered 1031 exchange is a wonderful opportunity remarkable investors. This is not a treatment for an investor acting that site alone. CWS Funding Allies has experience handling the entire 1031 exchange process for you and can work with you to offer replacement assets when you require them.

The details given right here is for your basic educational objectives just (have a peek at these guys). It must not be thought about a suggestion or customized consultatory advice. CWS has actually made this 3rd party info readily available from authors it believes are educated as well as trusted sources. Nevertheless, its accuracy or efficiency can not be assured and also view may change as a result of legal or economic problems.

How 1031 Exchange Real Estate can Save You Time, Stress, and Money.

You must familiarize yourself with all threats connected with any investment item prior to spending. Advisory solutions are supplied by CWS Capital Partners LLC, a licensed financial investment expert. Securities provided by CWS Capital Partners LLC are via an associated entity, CWS Investments. CWS Investments is a licensed Broker Dealership, member,.

A 1031 exchange is a kind of real estate purchase enabled under Area 1031 of the US Internal Income Code."Just how a 1031 exchange works, The precise 1031 exchange process depends on the kind you're using (much more on this later).

After that, like lots of capitalists, you'll probably intend to have a certified intermediary hold the profits of your sale till you have actually recognized the building or residential or commercial properties you would love to acquire. Afterwards, you have 45 days to locate your substitute financial investment and 180 days to acquire it. You can anticipate a certified intermediary to cost around $600 to $1,200, depending upon the deal.

1031 Exchange Rules Fundamentals Explained

For household rental homes, the benefit is slowly expanded over 27 years. Normally, if you made use of devaluation to your benefit, after that you 'd owe what's referred to as devaluation recapture - or revenue tax obligations on the monetary gains you realized from doing so - as soon as you sell the residence. Using a 1031 exchange can enable you to push these settlements out to a later date. 1031 exchange rules.

You'll still owe a range of closing expenses and also other charges for purchasing and also selling a residential or commercial property (websites). Several of these might be covered by exchange funds, yet there's discussion around specifically which ones. To discover which prices and also charges you might owe for a 1031 exchange deal, it's finest to speak to a tax professional.